Newsroom

Learn about our company, founders, and customers;

find photos and product images, our logo and other imagery.

TikTok Shop Makes Up Nearly 20% of Social Commerce in 2025

TikTok is driving social commerce growth—on track to make up nearly one-quarter of the sector

December 9, 2025 (New York, NY) – This holiday season, an increasing number of US shoppers will buy gifts on TikTok Shop and other social commerce sites, fueling rapid growth of the ecommerce subsector. In fact, social commerce* in general will grow by double digits in 2025 through at least 2029. A notable portion of that growth will be attributed to TikTok, according to Emarketer’s inaugural forecast for TikTok Shop.

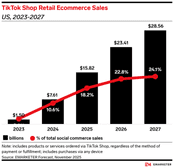

Since its US launch in September 2023, TikTok Shop has become a social commerce juggernaut. It grew its US sales by 407.0% in 2024, growing another 108.0% this year to reach $15.82 billion. That means it now commands 18.2% of total social commerce in the US, with that share expected to hit 24.1% by 2027. While Emarketer does not break out the other social shopping platforms, we know the other 75% is dominated mainly by Facebook Marketplace, as well as Instagram.

“TikTok’s ability to blend shopping and entertainment is turning the platform into an ecommerce powerhouse,” said Rachel Wolff, retail and ecommerce analyst at Emarketer. “While price concerns and value are top of mind for consumers this holiday season, so too is the desire to shop for fun—an itch that TikTok Shop is perfectly placed to scratch.”

TikTok Shop’s ecommerce growth will increase by double digits through the end of our forecast period in 2029. Its sales will surpass $20 billion in 2026 and reach over $30 billion in 2028.

“TikTok Shop has used its social influence to become a hyper-effective product discovery and recommendation engine, while also plowing money into discounts and incentives to increase its appeal to buyers and sellers,” Wolff said.

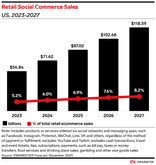

Although social commerce still represents a small percentage of the retail ecommerce pie (6.9%), its share is steadily increasing, reaching 9.3% in 2029. US social commerce sales will amount to $87.02 billion in 2025, up 21.5% year over year. In 2026, social commerce sales will grow another 18.0%, surpassing $100 billion for the first time.

“When it comes to social commerce, TikTok Shop has few rivals,” Wolff said. “No other platform—except perhaps Pinterest—has the same ability to facilitate product discovery and inspire users to shop. To maintain its dominance, TikTok will have to attract more household names to its platform, which should get easier the larger it grows. The pending sale of TikTok US to a consortium of investors could challenge the company’s ecommerce ambitions, although reports that ByteDance will maintain control over that side of the business could make a transition less disruptive.”

BUYERS

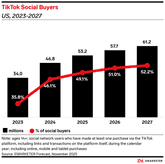

In terms of shopping, TikTok will reach a milestone in 2026, with its user base surpassing 50% of US social buyers. Put another way, 1 in 2 social media shoppers are making purchases on TikTok. Importantly, these figures include TikTok broadly, not just TikTok Shop. The number of TikTok buyers will grow 13.6% in 2025 to 53.2 million, and another 8.6% to 57.7 million in 2026.

“TikTok Shop’s user base skews young and discovery-driven, with much of the research agreeing that growth is primarily coming from Gen Z and millennial adoption,” said Oscar Orozco, senior forecasting director at Emarketer. “Health, wellness, and beauty are top categories, followed by accessories, household items, fashion, and cosmetics, according to our research. TikTok Shop’s best-selling items combine low price points, spur-of-the-moment appeal, trendiness, and they rely heavily on strong creator amplification.”

The total number of US social buyers (ages 14 and over) will grow 6.8% this year to reach 108.3 million. That equates to 47.9% of social network users and 47.5% of digital buyers. By 2028, more than half of digital buyers will have purchased a product on a social network.

“The considerable increase in the amount of shoppable content—including livestreams featuring celebrities like Kim Kardashian and John Legend—is both getting users accustomed to the idea of social shopping and encouraging them to make impulse purchases as they scroll through their feeds,” Wolff said.

*We define social commerce as the sale of products or services ordered by buying directly on a social platform, or through clicking links on a social network that lead to the retailer’s product page with an immediate purchase option. As with all our retail metrics, we exclude things like travel and event tickets and the purchase of vice goods.

Methodology

EMARKETER forecasts and estimates are based on our proprietary analysis and include both quantitative and qualitative data curated from public companies, government agencies, research and media firms, and interviews with expert executives in relevant fields. We regularly re-evaluate available data to ensure our forecasts reflect the latest business and economic developments and trends.

About Emarketer

EMARKETER is the go-to forecasts, data and insights provider across the marketing & advertising and ecommerce fields. We empower companies to make informed decisions that maximize revenue, optimize spend and anticipate digital disruption by providing actionable forecasts and context from expert analysts, carefully vetted data sources and our proprietary research methodology. EMARKETER is a division of Axel Springer S.E.

Contact Info

Are you a member of the press with a question about EMARKETER?

Submit your request here.

PR Director

Douglas Clark

Are you a member of the press with a question about EMARKETER?