Already have a subscription?Sign In

Log in to see the full chart

Log in or register for a free account to get full, unrestricted access to this chart

Log in to see the full chart

April 19, 2018

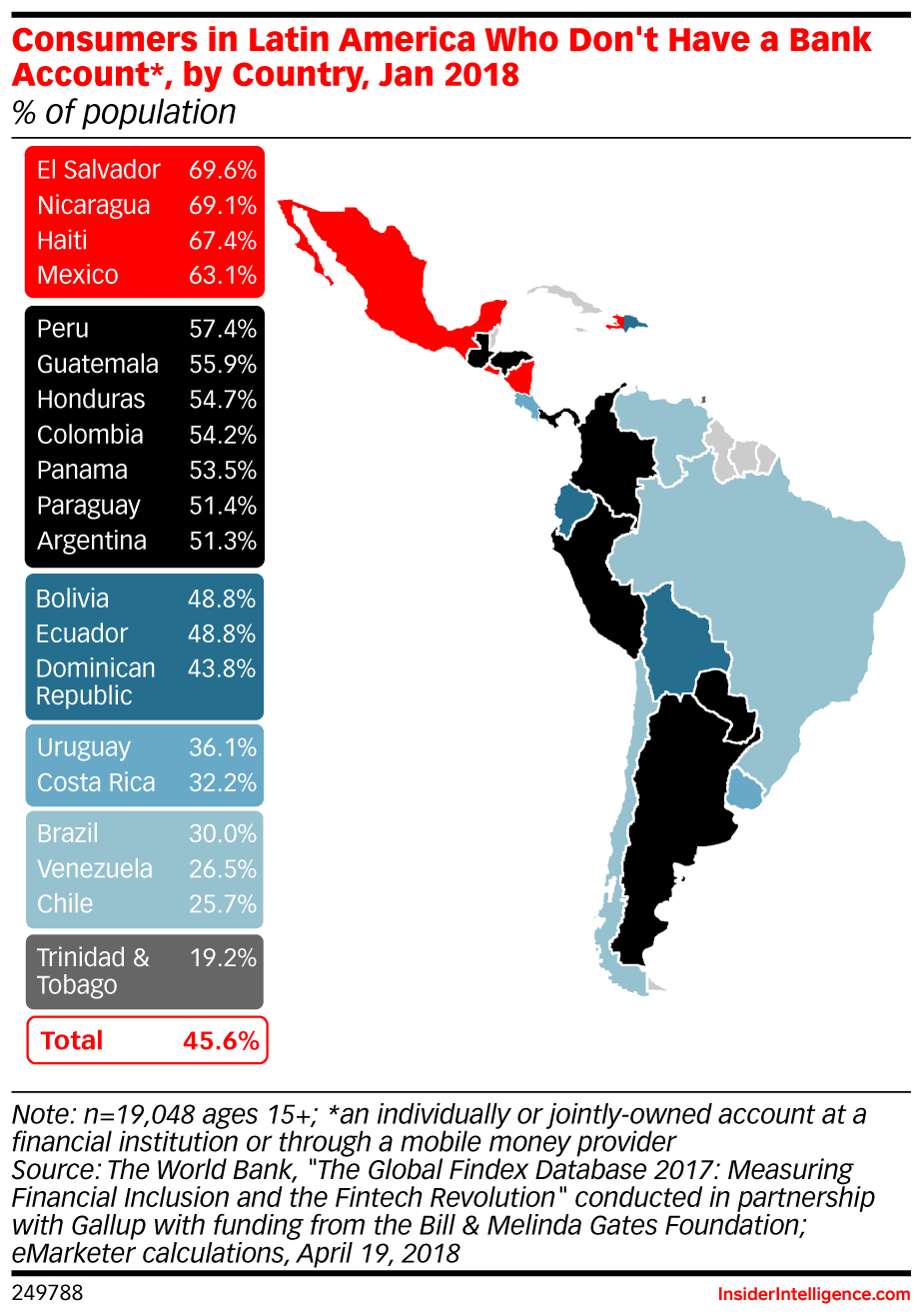

Consumers in Latin America Who Don't Have a Bank Account*, by Country, Jan 2018 (% of population)

Description

This chart looks at bank account penetration among consumers from 20 countries in Latin America. A bank account refers to an individually or jointly owned account at a financial institution or through a mobile money provider.Note

The World Bank defines a bank account as an individually or jointly owned account at a financial institution or through a mobile money provider. Financial institutions include banks or another type of formal, regulated financial institution, such as a credit union, a cooperative, or a microfinance ... institution. Mobile money providers consist of mobile phone-based services, not linked to a financial institution, that are used to pay bills or to send or receive money. These mobile money accounts allow people to store money and to send and receive electronic payments.Methodology

Data is from the April 2018 The World Bank report titled "The Global Findex Database 2017: Measuring Financial Inclusion and the Fintech Revolution" conducted in partnership with Gallup with funding from the Bill & Melinda Gates Foundation. 154,923 consumers ages 15+ from 144 countries were surveyed in-person and via phone during January 30, 2017-January 18, 2018. In Latin America and the Caribbean, 19,048 consumers ages 15+ were surveyed in person during April 19, 2017-January 18, 2018. Respondents were from the following 20 countries: Argentina (n=1,000), Bolivia (n=1,000), Brazil (n=1,000), Chile (n=1,040), Colombia (n=1,000), Costa Rica (n=1,000), Dominican Republic (n=1,000), Ecuador (n=1,000), El Salvador (n=1,000), Guatemala (n=1,000), Haiti (n=504), Honduras (n=1,000), Mexico (n=1,000), Nicaragua (n=1,000), Panama (n=1,000), Paraguay (n=1,000), Peru (n=1,000), Trinidad and Tobago (n=504), Uruguay (n=1,000) and Venezuela (n=1,000). There is an average margin of error of +/-3.8 percentage points with a 95% confidence level for the region. The Global Findex database has been published every three years since 2011.Chart Title

Consumers in Latin America Who Don't Have a Bank Account*, by Country, Jan 2018 (% of population)Publication Date

April 19, 2018