Newsroom

Learn about our company, founders, and customers;

find photos and product images, our logo and other imagery.

Tariffs Cause Auto and Retail Sectors to Pull Back on Digital Ads

Total digital spend will grow a reduced 9.5% this year

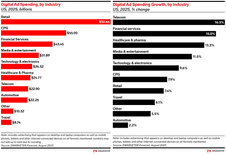

September 23, 2025 (New York, NY) – While some sectors have weathered the tariff storm, others have been hit harder due to their broader exposure to its economic impact. The hit to their businesses, in turn, has a direct impact on their ad spending. According to our latest forecast on ad spend by industry, the retail and auto sectors will pull back most on their digital ad spending this year, as tariffs hit their businesses hardest. Sectors such as telecom, financial services, and healthcare are the least affected and will continue spending on digital. Other sectors, such as media and entertainment, consumer electronics, and consumer packaged goods (CPG) are moderately affected by tariffs.

Total US digital ad spending will grow 9.5% by the end of this year to reach $338.27 billion. That’s a slight downgrade compared with our forecast last year, in which we predicted 11.5% growth in 2025.

HIGH IMPACT

AUTO

We have made the biggest adjustment in our digital ad spend forecast for the auto sector, the industry hit hardest by Trump’s tariffs. In our 2024 forecast, we expected automotive companies to grow their digital ad spend by 11.1% this year. We now expect growth to be just 2.2%. That means the industry’s digital spend will reach $22.25 billion, below $24.47 billion we anticipated in the last forecast.

“A 25% US tariff on imported cars and parts, introduced in April, immediately raised vehicle prices by thousands of dollars,” said Oscar Orozco, forecasting director at Emarketer. “While this sparked a brief surge in pre-tariff sales, demand has cooled sharply in the second half of the year. In response, the industry is shifting what spend remains toward performance-driven digital channels, where ROI can be more closely measured.”

RETAIL

The retail sector will also pull back on digital ad spending, although not as much as the auto industry. Last year, we predicted retailers would spend $93.64 billion this year on digital ads, up 12.7%. Now we expect that figure to grow by just 7.4% to reach $92.64 billion.

“Not all retail categories are made equal: apparel and home furnishings, reliant on tariffed imports, have cut advertising most deeply,” said Orozco. “Athletics and baby/children’s products are moderating spend but remain visible. Restaurants and bars, less tied to import costs, have shown stability. Overall, retail is responding to cost inflation and consumer caution by pulling back aggressively on large campaigns, while concentrating remaining dollars in highly measurable, sales-focused channels.”

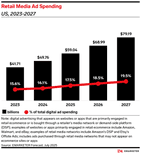

On the US side, retailers are reallocating reduced budgets toward channels that can demonstrate near-term ROI. Retail media networks (RMNs) are the clear winner, forecast to grow 18.7% this year to nearly $60 billion. Double-digit growth will continue in the years to come, with the ad channel taking up an increasing share of total digital spend.

TRAVEL

Travel and tourism is facing sharp headwinds, making this one of the hardest-hit advertising categories. Our 2024 forecast predicted 7.9% growth in the sector’s digital ad spend, reaching $8.34 billion. However, we now expect 2025 growth to be 6.1% or $8.74 billion. The current forecast predicts a higher dollar value due to 2024 figures coming in higher than expected.

“Unlike essential goods, travel is highly discretionary—and with tariffs driving up the cost of everyday items, households have less disposable income for vacations, flights, and hotels,” said Orozco. “The result is softer demand and more conservative ad budgets.”

Subverticals:

- High impact from tariffs: Airlines, cruise lines—slashing spend as demand softens.

- Medium impact from tariffs: Hotels and accommodations—moderating campaign ad budgets.

- Low impact from tariffs: OTAs—moving budgets into performance media, less exposed to discretionary cuts.

MODERATE IMPACT

MEDIA AND ENTERTAINMENT

While not directly affected by tariffs, the industry feels indirect pressure from advertisers in product-heavy verticals pulling back and from changing consumer behavior. Entertainment companies themselves continue to advertise, but strategies are more selective and performance driven.

In our 2024 forecast, we expected the media and entertainment industry to expand its digital ad spending by 15.0% to $32.37 billion in 2025. We now expect media and entertainment companies to increase their digital ad budgets by just 11.5%, reaching $31.89 billion. This is the first time the sector has surpassed $30 billion in digital ad spend.

“Netflix, Disney+, and Warner Bros. Discovery are locked in fierce competition for subscribers,” said Orozco. “And while ad budgets remain active, they are increasingly focused on ROI-driven digital campaigns, promotions, and partnerships rather than blanket marketing pushes. Companies will also heavily invest on mobile—both because of the younger cohorts they target and the platforms they utilize to reach these consumers.”

TECH AND CONSUMER ELECTRONICS

Consumer electronics companies* will increase their digital ad spend this year by 9.6%, reaching $26.32 billion. That’s a pullback from the 16.4% growth, or $27.46 billion, we expected in our 2024 forecast.

“Hardware margins are being squeezed, and marketers are responding with selective cuts and redeployment of budgets,” said Orozco. “Smartphone and PC makers reliant on Chinese manufacturing have been particularly affected. New tariffs have prompted some brands to redirect advertising to less-impacted regions or product lines. On the US side, major players like Apple, Google, and Amazon continue to advertise actively, though with more emphasis on performance marketing and product-specific campaigns.”

CPG

While still moderately affected by tariffs, CPG is bucking the trend. In last year’s forecast, we expected a slowdown in ad spend, not due to tariffs but mainly because spending had been robust in 2023 and 2024, over-indexing the total digital ad market.

“Last year, we also expected the economy would stabilize and CPG advertisers would feel less of a need to meet the consumer on their shopping journey with messaging, with consumers’ budgets stabilizing,” said Orozco.

This year, the sector will grow its digital spend by 7.9% to reach $55.00 billion. This is slightly higher than our prediction last year of 6.1% growth, reaching $52.99 billion. Even with a slightly higher growth figure expected, CPG growth will still be tempered by tariffs and will be lower than the double-digit growth from years past. It will under-index the market average of 9.5%.

“The CPG sector is facing heavy tariff headwinds, as global supply chain disruptions and duties on inputs such as aluminum and raw materials have driven costs sharply higher,” said Orozco. “While consumer demand remains resilient in core food and beverage segments, inflation and price sensitivity are weighing on volumes, forcing CPG firms to make trade-offs in spending.”

We expect relative strength from food (13.5%) and alcoholic beverage brands (11.0%)—mainly wine and domestic beer advertisers—while toiletries and cosmetics brands will hit the pause button (3.1%) after leading growth the past two years. Household cleaning supplies, cigarette products, and nonalcoholic beverage brands will all see single-digit digital ad spending growth in a down year for CPG.

CPG brands continue to skew their ad budgets toward display, as brand awareness remains the main goal. Display’s share of the digital ad market will hit 60% by 2029. However, we continue to see a sustained focus on search as D2C selling continues to grow as an option for shoppers. Because CPG brands’ preference for targeting consumers on social media platforms, mobile will continue to take the lion’s share of digital ad budgets. By the end of this year, nearly 35% of all CPG digital advertising will go to social network platforms, the highest of all industries we cover.

LOW-IMPACT

Telecom, financial services, and healthcare are relatively insulated from the effects of tariffs, as they are not directly affected by import duties. While the Trump administration has threatened new tariffs on imported drugs, ranging from modest to potentially extreme, the measures have not yet taken effect.

For more on telecom, financial services, and healthcare, please reach out.

*Technology and electronics includes hardware (computers, computer storage devices and computer peripheral equipment), consumer electronics, prepackaged software (operating, utility, and applications programs), local area network systems and network systems integration, computer processing, and data preparation and data processing services.

Contact Info

Are you a member of the press with a question about EMARKETER?

Submit your request here.

PR Director

Douglas Clark

Are you a member of the press with a question about EMARKETER?