Newsroom

Learn about our company, founders, and customers;

find photos and product images, our logo and other imagery.

<strong>Netflix Ad Revenues Surpass Disney+, But For How Long?</strong>

Netflix ad revenues to grow 50.3% in 2024

December 12, 2023 (New York, NY) – One year after Netflix and Disney+ launched their ad-supported tiers, the fight for ad dollars is heating up. Netflix is poised for explosive growth in 2024. In fact, in its latest US ad forecast, Insider Intelligence expects Netflix ad revenues to surpass that of Disney+ next year. But will it be able to hold onto its lead?

By the end of 2023, we expect Disney+ to generate $785.6 million in ad revenues versus Netflix’s $684.6 million. This will have been the first full year of both companies’ ad-supported versions.

“Having an established advertising infrastructure and previous experience selling streaming advertising allowed Disney+’s ad tier to get a fast start,” said Insider Intelligence senior analyst Ross Benes. “Netflix just started selling advertising for the first time, so its ad product has taken longer to gain traction.”

But the tide will shift next year, as Netflix ad revenues will grow an impressive 50.3%, compared with just 16.1% for Disney+. That puts Netflix ahead in terms of total revenues, with $1.03 billion versus $911.9 million for Disney+. “Subscription fee increases and password-sharing restrictions will push more Netflix viewers toward advertising,” Benes said. “Because viewers tend to spend more time per day with Netflix than with other streaming services, Netflix’s ad revenues are poised to grow significantly as more viewers come aboard.”

The gap will narrow in 2025 as Netflix’s ad growth slows to 11.3% and Disney+’s growth accelerates to 20.2%.

TIME SPENT

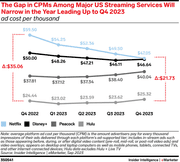

Insider Intelligence projects ad revenues based on costs per thousand (CPMs) and time spent on each platform among adult viewers. CPMs for each company are now about the same, with Netflix slightly higher as of Q4.

Time spent among adult viewers of each platform is much higher for Netflix at 1 hour per day, compared with Disney+’s 23 minutes per day. But Disney+ has higher ad loads, helping it stay competitive with Netflix in terms of total ad revenues.

AD-SUPPORTED VIEWERSHIP

Another important factor keeping Disney+ neck and neck with Netflix is the fact that it relies much more heavily on ad-supported viewers. In 2024, it will have 27.2 million ad-tier viewers (23.5% of its total viewer base), compared with Netflix’s 13.0 million (7.5% of its total viewer base).

Ad-supported viewer growth will be a key driver for Netflix’s bump in ad revenues next year. Ad-tier viewers on Netflix will grow 69.7% in 2024, raising it to 13.0 million people. Also, Netflix’s crackdown on password-sharing earlier this year will continue to steer more viewers toward the ad-supported tier.

So while Netflix ad revenues will remain ahead of Disney+ revenues through 2025, the end of the forecast period, Disney+ could overtake Netflix in 2026 or beyond.

“Disney is tinkering with merging Disney+ and Hulu into a single app. Should the single app experience become common, Disney+ stands to gain ad revenues from its association with Hulu, which is one of the largest sellers of streaming advertising,” Benes said.

Methodology

Insider Intelligence forecasts and estimates are based on our proprietary analysis, and include both quantitative and qualitative data curated from public companies, government agencies, research and media firms, and interviews with expert executives in relevant fields. We regularly re-evaluate available data to ensure our forecasts reflect the latest business and economic developments and trends.

About Insider Intelligence

Insider Intelligence is a leading research provider focused on digital transformation. We empower professionals with actionable data, insights, and analysis to make informed decisions in a digital world. Formed as a merger of eMarketer and Business Insider Intelligence in 2020, we produce nearly 200 forecasts, 300 reports, 7,000 charts, and 1,500 newsletters across the Advertising, Media, and Marketing; Financial Services; Healthcare; and Retail and Ecommerce industries. Insider Intelligence is a division of Axel Springer S.E.

Contact Info

Are you a member of the press with a question about EMARKETER?

Submit your request here.

PR Director

Douglas Clark

Are you a member of the press with a question about EMARKETER?