Newsroom

Learn about our company, founders, and customers;

find photos and product images, our logo and other imagery.

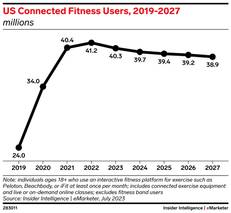

Connected Fitness Users Starting to Decline

Peloton will lose 900,000 members in the US in 2023

August 28, 2022 (New York, NY) – After explosive growth in 2020 when gyms closed amid the pandemic and Americans were forced to work out at home, the connected fitness industry is now seeing a slow decline. According to the latest forecast from Insider Intelligence, far fewer US adults will use Peloton, Beach Body, and iFit products in 2023 than in years past. The only bright spot is Nautilus, which will maintain slow but positive growth.

Total connected fitness users (ages 18 and older) will decline 2.3% by the end of 2023 to 40.3 million. This comes after peaking at 41.2 million last year. The category grew 41.5% in 2020 as at-home fitness products enabled social distancing. Double-digit growth continued into 2021, but then came to a near standstill in 2022 as most gyms reopened. By 2027, users will drop to 38.9 million adults, slightly lower than 2021 levels.

“Connected fitness is fading as users return to gyms, but also as they turn more to the tech platforms they already use daily to work out,” said Peter Newman, forecasting director at Insider Intelligence. “Using health apps and tools from platforms like Apple, Google (including Fitbit) and Samsung, consumers are tracking activity on smartphones and watches, pulling market share away from dedicated platforms.”

Peloton will lose nearly 900,000 US adult users this year, at a decline of 14.3% to 5.4 million users. That drops its usage to below 15% of US connected fitness users for the first time since 2021. Declines will continue through 2027, albeit at a much slower rate, when usage will drop to 5.0 million.

On a percentage basis, Beachbody will see the biggest drop in US users, mainly because its base is smaller than that of competitors. Its usage will plummet 37.7% this year to 2.1 million US adults. That’s down from its high of 3.6 million in 2020. Its share of the market is small, capturing just 5.1% of connected fitness users. By 2025, total usage will drop below 2 million for the first time since 2017.

iFit’s user base will decline 8.1% this year to 4.8 million, after growth peaked in 2022. It will continue declining slowly through 2027, with its share of connected fitness users dropping to 10.9%, off a high of 12.8% in 2021.

Nautilus, by far the smallest player that we track, is the only one that will experience positive growth. While its user base will only grow by about 2% a year through the end of our forecast period, it’s the only one that won’t lose users. This year, it will have over 405,000 adult users in the US, with that figure growing to nearly 440,000 by 2027.

“The relative success of Nautilus stems from its very small starting base of digital users,” said Newman. “The extensive reach and relatively lower bar of entry for many users is keeping its connected services above water on the growth front.”

Contact Info

Are you a member of the press with a question about EMARKETER?

Submit your request here.

PR Director

Douglas Clark

Are you a member of the press with a question about EMARKETER?